Rising Mortgage Rates Make Home Buying More Difficult

According to the latest report, mortgage rates in the U.S. continued to climb, reaching 7.85%, the highest level in 23 years. This increase is occurring amid high inflation rates and potential expectations of further interest rate hikes by the Federal Reserve (Fed). Experts are looking at the future of the housing market with great concern, as such rates make home buying less accessible for most Americans.

Continue reading

Cars with the Worst Depreciation in 2025

According to a recent study published by Motor1, several car models are expected to experience significant price declines in 2025. This information is crucial for potential buyers considering the long-term investment in certain vehicles.

Continue reading

The Troubling State of American Consumers: Confidence Plummets Due to Prices

Recent research has shown a significant drop in American consumer confidence, driven by rising prices for goods and services, a consequence of inflation and tariffs. The University of Michigan's Consumer Sentiment Index fell to 57.7 in September, the lowest level since 2011. This decline in confidence reflects people's concerns about future financial difficulties as prices for essential items, including food and fuel, continue to rise.

Continue reading

Mustang GTD: A New Turn for Owners After Two Years

According to the latest news, Ford has launched a new lineup of the Mustang GTD, which stands out not only for its impressive performance but also for its unique ownership conditions. New Mustang GTD owners are required to keep their cars for no less than two years. This decision is aimed at ensuring that these vehicles are placed in the hands of true enthusiasts, rather than being quickly resold by resellers.

Continue reading

Google Parent Company Announces Historic First Dividend, Surpassing Sales and Profit Expectations

For the first time in its history, Google's parent company, Alphabet Inc., has declared a dividend. This significant event came as the company reported record sales and profit figures for the last quarter. The financial report showed that Alphabet's revenue increased by 11% compared to the previous year, totaling $76 billion. The company's net profit was equally impressive, reaching $17 billion, which is a 17% rise from the same period last year.

Continue reading

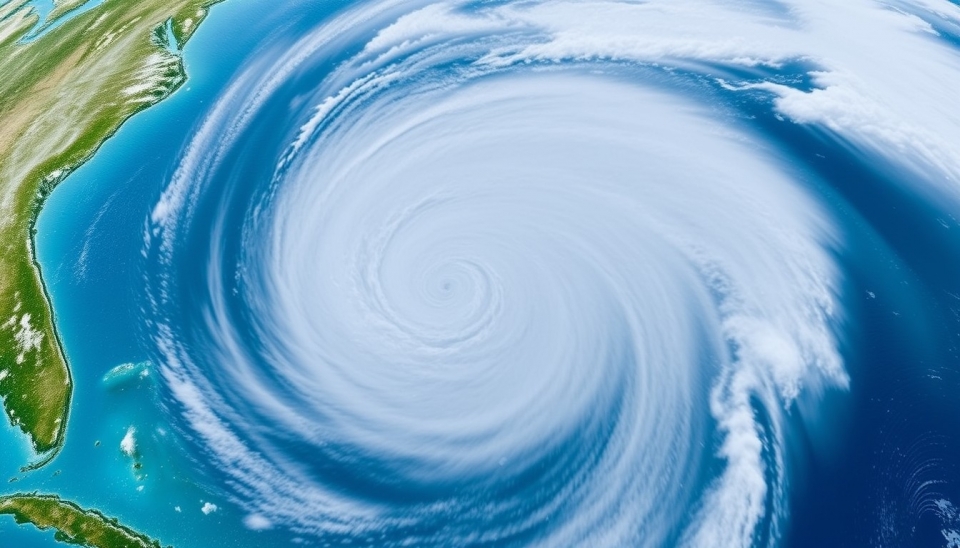

Hurricane Francine Set to Cost Insurers Nearly $1.5 Billion

Hurricane Francine, which impacted the Caribbean and southeastern United States, is expected to be one of the most destructive weather events of the year, with damage costs estimated at nearly $1.5 billion. The loss data was released by a risk management analytics firm, which provided facts and figures confirming the severity of the situation arising from the hurricane.

Continue reading

Financial Stability in France: Bank of France Head Calls for Budget Credibility

The head of the Bank of France, Vitaly Shimen, expressed serious concern about the current state of the country's economy, stating the need for increased budget credibility for sustainable growth. In his recent statement, he emphasized that fiscal policy plays a key role in managing inflation and ensuring long-term economic well-being.

Continue reading

Pimco Predicts Possible Bank of Japan Interest Rate Hike in January 2024

According to the latest analysis from investment management firm Pimco, the Bank of Japan (BoJ) is expected to raise interest rates as early as January 2024. This statement coincides with a broader trend seen in the global economy, where central banks are taking actions to adjust their monetary policies in response to rising inflation and economic activity.

Continue reading

Bank of Canada Prepares for Soft Economic Landing: A Clear Path Ahead

The Bank of Canada is poised for a significant phase as the country's economy displays signs of stability following periods of uncertainty. In a recent statement, the central bank highlighted that the current economic situation suggests a possibility of a "soft landing" — a term describing a smooth transition from economic growth to a slowdown without sharp declines. This optimistic expression reflects the central bank's outlook on stable development, assessing current macroeconomic indicators.

Continue reading