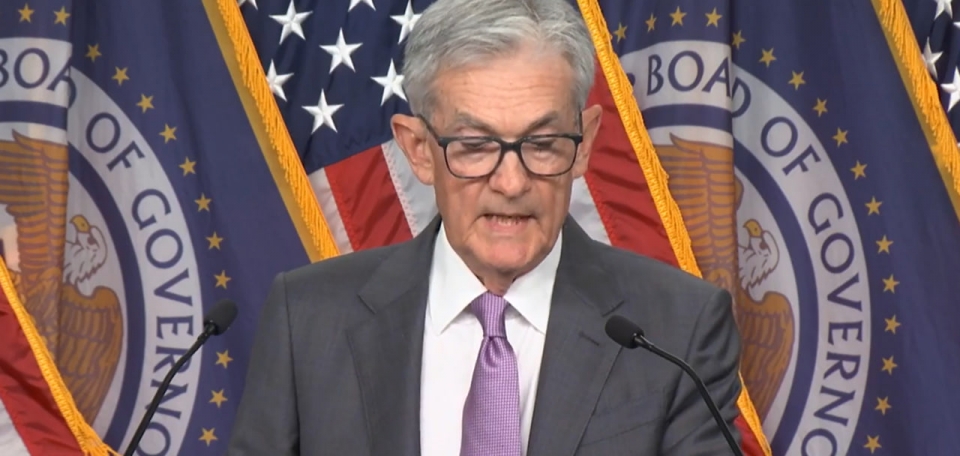

Potential Challenges for the Federal Reserve Due to Tariffs, Says Jerome Powell

The head of the Federal Reserve, Jerome Powell, has stated that the central bank may face complex scenarios related to the implementation of trade tariffs. Powell pointed out that the increase in import tariffs could significantly impact the economy, complicating the task of controlling inflation and maintaining economic growth.

Continue reading

Fed Chair Jerome Powell Warns About Potential Inflation Rise Due to Tariffs

Federal Reserve Chair Jerome Powell stated in a recent interview that rising tariffs could lead to an increase in inflation, which could be persistent. He noted that the current economic conditions, particularly the impact of tariffs on imports, create risks that could change price dynamics for both consumer goods and services.

Continue reading

Fed Chair Jerome Powell Responds to Elon Musk's Criticism

Federal Reserve Chair Jerome Powell addressed recent critical remarks made by Elon Musk regarding the Federal Reserve's operations and staffing levels. Musk, known for his provocative comments, claimed that the Fed is overworked and inefficient. In response, Powell emphasized that the Fed is not overstretched but, rather, has all the necessary resources to perform its functions effectively.

Continue reading

Powell Pushes Back on Musk's Claim That the Fed is "Absurdly Overstaffed"

Federal Reserve Chair Jerome Powell has responded to recent comments by Elon Musk, who stated that the Fed is, in his opinion, "absurdly overstaffed." During his speech, Powell emphasized that the number of employees at the Fed is adequate for fulfilling the central bank's tasks in line with its current mission. He added that the Fed's workforce has been reduced in recent years to effectively respond to the economic situation and maintain financial stability.

Continue reading

Federal Reserve's Interest Rate Decision for January 2025

The Federal Reserve of the United States made an important announcement regarding its interest rate plans, confirming decisions that have a significant impact on the nation's economy. In its latest meeting held in early January 2025, the Fed decided to keep the current rate in the range of 5.25% to 5.50%. This decision comes amid ongoing inflationary growth, highlighting the need for caution from the central bank. Fed Chair Jerome Powell noted that the current macroeconomic conditions require stability in monetary policy to avoid further unexpected fluctuations in financial markets.

Continue reading

Federal Reserve in No Rush to Reach Neutral Interest Rate, Says Jerome Powell

The Chair of the U.S. Federal Reserve, Jerome Powell, recently stated that the central bank is not in a rush to reach the neutral interest rate, which is deemed the optimal level to stimulate the economy without overheating it. In a meeting with reporters, he explained that the Fed's approach is aimed at maintaining economic stability rather than hastily achieving specific targets.

Continue reading

Federal Reserve Creates Policy Space in Global Economy

The Federal Reserve of the United States (Fed) is opening new opportunities for monetary policy both domestically and internationally. The latest Fed meeting concluded with interest rates remaining unchanged, providing central banks in other countries with greater maneuvering space. This decision was made against the backdrop of increasing global instability and economic uncertainty.

Continue reading

Federal Reserve Prepares to Cut Rates to Support Economic Soft Landing

The Federal Reserve (Fed) of the United States has decided to take decisive steps to stabilize the country's economy, considering a potential interest rate cut in the near future. Fed Chair Jerome Powell emphasizes that this decision is aimed at supporting growth and ensuring a smooth adjustment of the economy following a series of rate hikes in the past. Powell states that such measures could help mitigate the negative consequences of a potential recession and improve the chances of a soft landing.

Continue reading

The Federal Reserve and Its Impact on the Global Market: The Challenges of a Soft Landing

Recently published data shows that the United States Federal Reserve (Fed) is at a crossroads, considering changes to interest rates in the context of the current economic situation. Fed Chairman Jerome Powell refers to his strategy as a "soft landing," suggesting that the central bank can slow down economic growth and control inflation without serious consequences for the labor market.

Continue reading

Economic Markets Await Jerome Powell's Decision to Avoid Recession

Recent financial analysis highlights that current global markets are at a crossroads due to the upcoming decision by Federal Reserve Chair Jerome Powell. The main question is whether he can replicate the successful actions of his predecessor Alan Greenspan, who navigated the economy through a challenging period in the 1990s known as the "soft landing." A soft landing refers to slowing economic growth without transitioning into a recession.

Continue reading