Trump Calls for Fed to Cut Interest Rates and Stop Playing Politics

Former US President Donald Trump has once again criticized the Federal Reserve (Fed) and its Chair Jerome Powell. On his social media page, he urged the Fed not to engage in politics and focus on the economy. According to Trump, high interest rates are negatively impacting economic growth, and it's time to lower them. He believes the Fed's economic policy is leading to increased unemployment and lowered consumer spending.

Continue reading

CEO Bank of America Brian Moynihan Predicts No Interest Rate Cuts in 2023

Bank of America CEO Brian Moynihan expressed confidence that there will be no cuts in interest rates in the current year of 2023. During a recent interview, he noted that the economic environment in the country remains challenging, and it is expected that the Central Bank will continue to adhere to a tight monetary policy. According to him, rising inflation and complicated supply chains leave little basis for lowering rates in the near future.

Continue reading

Federal Reserve's Key Interest Rate Decision in March 2025

In March 2025, the United States Federal Reserve will hold an important meeting to decide on interest rates. Investors and economists are closely monitoring current economic indicators that could influence the Federal Reserve's decisions. In recent months, there have been changes in inflationary trends and household wealth, making this meeting particularly significant.

Continue reading

Rate Cut Projections: What the Market Expects in 2024

Recently, there has been a growing interest in the topic of interest rate cuts in the U.S., particularly in light of the current economic conditions. Economists and analysts are paying attention to possible changes in monetary policy that may take place throughout 2024. Currently, the market is anticipating several rate cuts during the year, which could significantly impact the country's financial system.

Continue reading

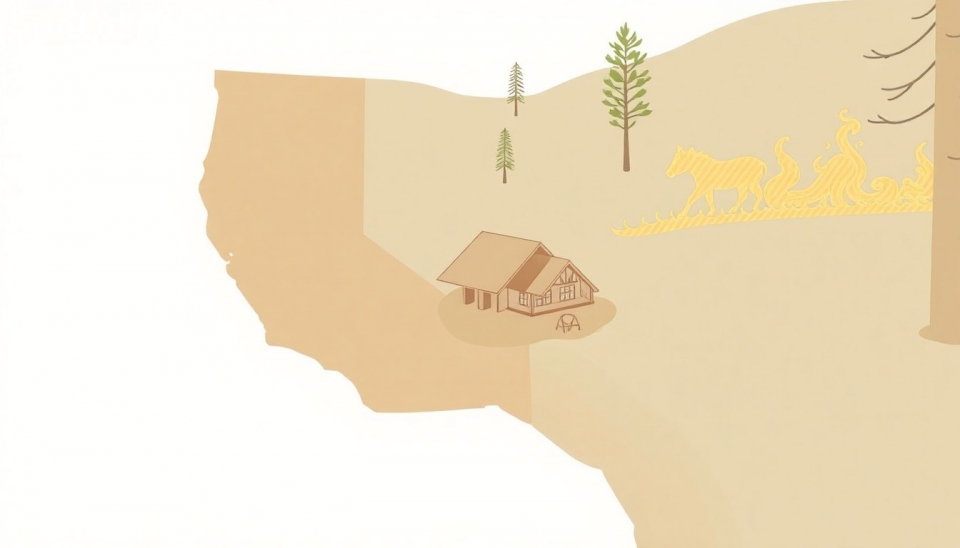

State Farm Requests Rate Increases in California Following Devastating Wildfires

The insurance company State Farm has recently filed an official request with California regulators to approve an increase in insurance rates for its customers. This decision was made following a series of devastating wildfires that swept through the state, leaving behind immense damages and increasing costs for insurance companies. State Farm argues that the rate hike is necessary to ensure financial stability and the ability to pay claims for affected households.

Continue reading

Federal Reserve's Interest Rate Decision for January 2025

The Federal Reserve of the United States made an important announcement regarding its interest rate plans, confirming decisions that have a significant impact on the nation's economy. In its latest meeting held in early January 2025, the Fed decided to keep the current rate in the range of 5.25% to 5.50%. This decision comes amid ongoing inflationary growth, highlighting the need for caution from the central bank. Fed Chair Jerome Powell noted that the current macroeconomic conditions require stability in monetary policy to avoid further unexpected fluctuations in financial markets.

Continue reading

Federal Reserve’s Interest Rate Decisions and Trump’s Economic Policies: A Critical Intersection

Recently, the Federal Reserve (Fed) of the United States decided to maintain interest rates at a level that significantly impacts the economic situation in the country. This decision has become a topic of discussion among economists, financial analysts, and politicians, particularly in the context of upcoming elections and the policies of former President Donald Trump.

Continue reading

Expectations for Federal Reserve's Interest Rate Hike in December 2024

In recent months, the situation in financial markets has been under close scrutiny as the U.S. Federal Reserve (Fed) continues to set its interest rate policy. Increasingly, analysts are starting to speculate that another rate hike may occur in December 2024, provided economic conditions allow for it.

Continue reading

Mortgage Rates Decrease: Lowest Levels Since October

In the last two weeks, mortgage rates have continued to decline, reaching levels not seen since October. Data from Freddie Mac shows that the average rate for a 30-year fixed mortgage is at 7.12%, which is 0.06% lower than the previous week's figure.

Continue reading

Federal Reserve discusses potential interest rate cuts

Federal Reserve Chair Charles Goolsbee has made a statement advocating for a review of the current monetary policy with the goal of possibly lowering interest rates in the future. In his remarks, he emphasized that high rates could negatively impact the economy, leading to slowed growth. Goolsbee stressed that further rate hikes could complicate matters for businesses and consumers, urging a cautious approach.

Continue reading