The Federal Reserve Cuts Interest Rates by Half a Point: What It Means for the Economy

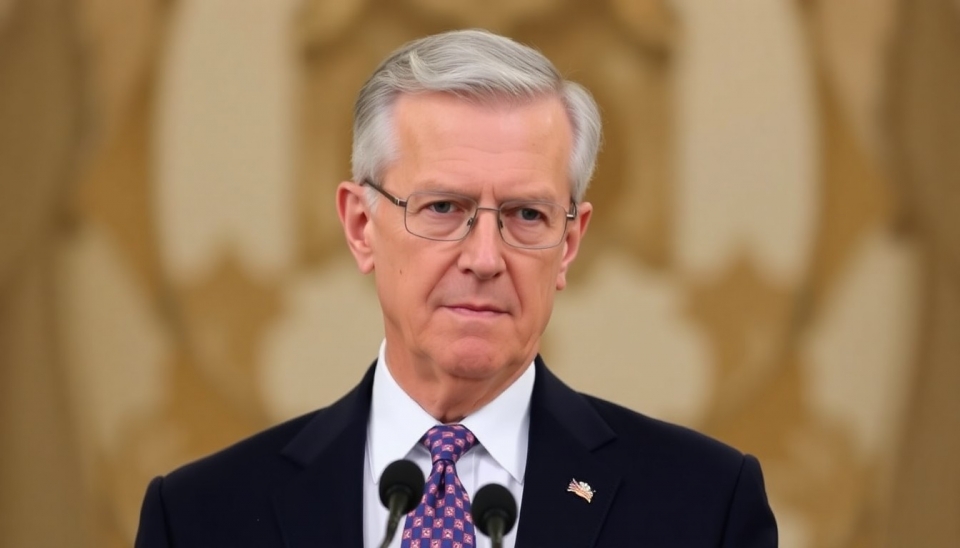

In a recent decision, the Federal Reserve (Fed) of the United States announced a reduction of the key interest rate by 0.5%. This event marks a significant measure in response to current economic conditions and the risks facing the American economy. The restructuring of interest rates was anticipated among analysts, as economic data shows slowing growth, high inflation, and uncertainty in the labor market.

The purpose of the rate cut is to stimulate economic activity. Lower interest rates make loans more accessible to businesses and consumers. This could lead to increased spending, which in turn promotes economic growth. However, the rate cut may also signal possible economic difficulties that the Fed is trying to mitigate.

Furthermore, the Fed noted that this decision is driven not only by domestic economic issues but also by global factors. Uncertainty on the international stage, including trade disputes and changes in the global economy, is putting pressure on the bank's leadership as it seeks to maintain stable growth.

In its statement, the Fed emphasized that it will closely monitor the economic situation in the coming months and is prepared to take additional measures to support the economy if necessary. Market participants, in turn, expect further rate cuts, highlighting growing concerns about the sustainability of economic growth.

The reduction in the key interest rate will impact various segments of the economy, including mortgage and auto loans, as well as the stock market. This decision may lead to asset price increases, as investors look for more favorable investment conditions with the lower rates.