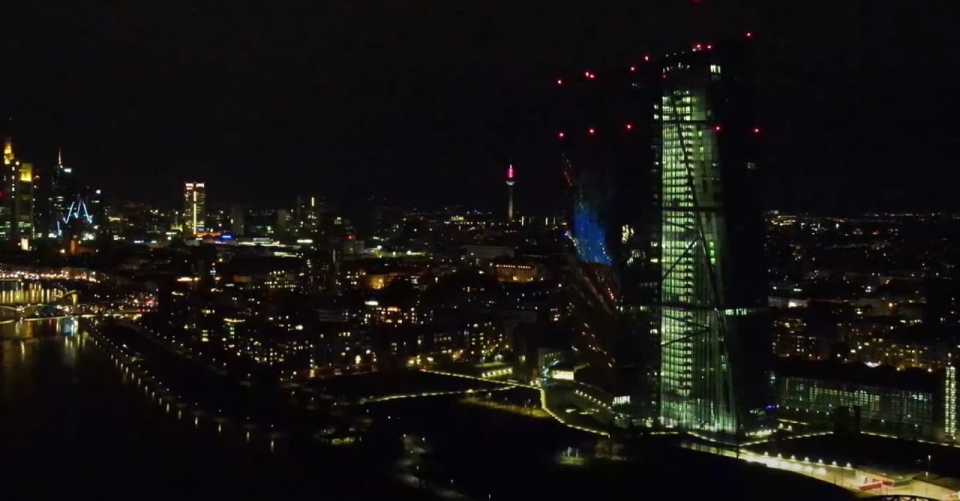

The ECB Considers Rate Cuts, but Warns of Inflation Risks

According to Jens Weidmann, a senior official at the European Central Bank (ECB), interest rates in the Eurozone should be lowered in the future, but there are significant concerns regarding inflation that need to be addressed. Weidmann, who serves as the president of the Deutsche Bundesbank, stated that the current rate hikes were necessary to combat ongoing inflation. However, in the long term, he believes rates should be lowered to support economic activity.

At a recent event, Weidmann emphasized that final decisions will depend on demonstrating sustained signs of declining inflationary pressure in the region. Additionally, he noted that there are structural factors contributing to inflation, such as global supply chains and rising energy prices, which are difficult to manage. Against the backdrop of uncertainty in the Eurozone economy, the ECB continues to monitor the situation and take necessary measures.

Some economists express that in the current economic climate, the approach to managing interest rates should be cautious and measured. The resilience of the Eurozone economy remains under significant pressure, and the decision to lower rates requires careful assessment of inflation-related risks.

Weidmann added that the ECB must act proactively and be prepared to adjust its monetary policy based on final data and market changes. In conclusion, he stated that economic stability and inflation control should remain top priorities on the central bank's agenda.