Fed Rate Cuts and Market Insights at Jackson Hole Symposium

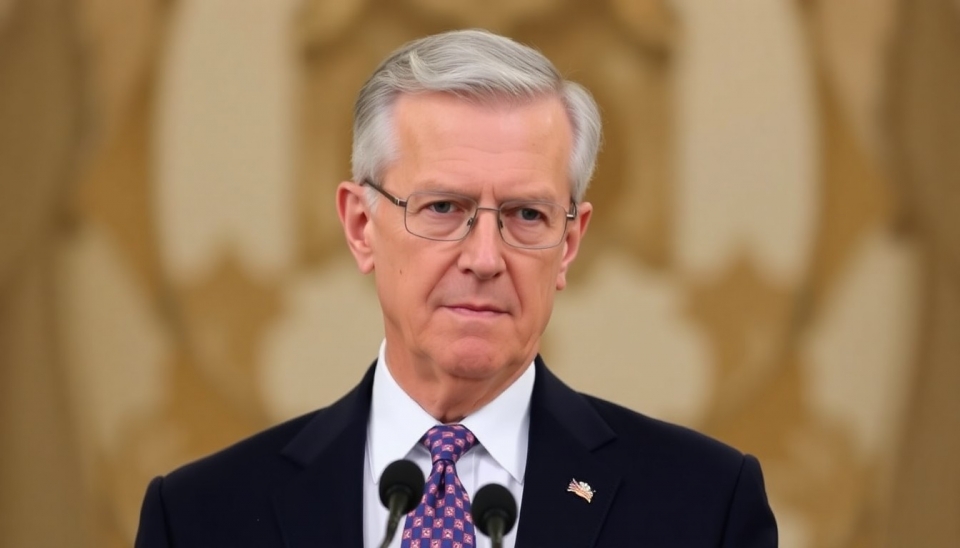

During the annual Jackson Hole symposium, Federal Reserve Chair Jerome Powell is expected to take center stage in discussions surrounding financial policy amidst market uncertainty. Investors and economists are closely monitoring his statements, as they may signal potential shifts in monetary policy.

The economic landscape in the U.S. raises numerous questions. Despite low unemployment and signs of economic resilience, inflation continues to challenge markets. Powell is under pressure to clarify how the Fed plans to navigate these dual challenges, especially as investors anticipate possible rate cuts. This could mark a critical moment, particularly if the central bank opts to respond to the changing economic environment.

In addition to domestic economic factors, the symposium is appealing to market participants because it provides an opportunity for exchanges with international economists and financiers. The involvement of key figures from institutions like the European Central Bank may lead to broader discussions on global economic prospects and central bank coordination worldwide.

It is expected that during the symposium, Powell will emphasize the importance of balancing economic growth with inflation control. Investors are hopeful for clear signals on how the Federal Reserve might adapt its policies in light of changing economic conditions, which could lead to significant fluctuations in financial markets.

Given all this uncertainty, attention towards the Jackson Hole symposium is only increasing, and market participants are preparing for potential changes in monetary policy that may impact their strategies in the near future.

#Fed #JeromePowell #RateCuts #USEconomy #JacksonHoleSymposium