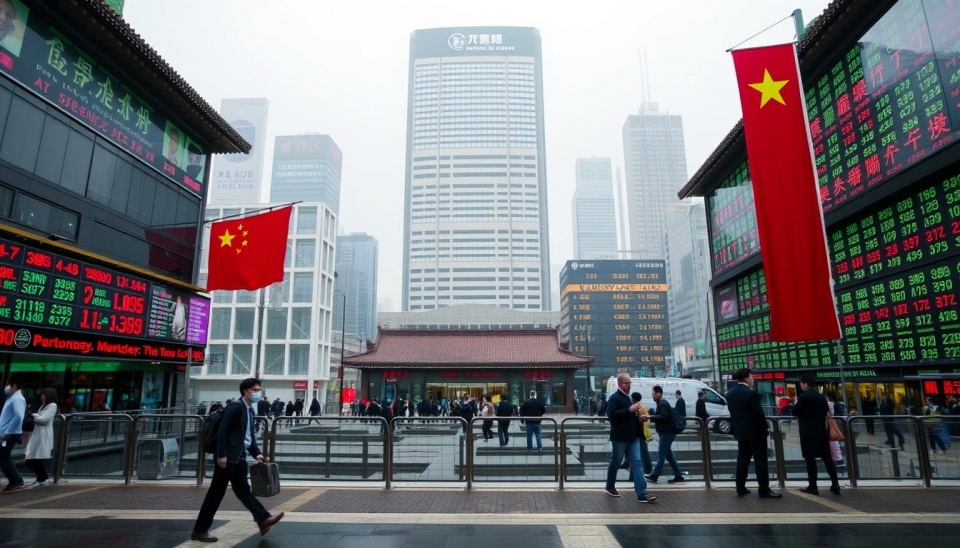

Chinese Stocks on the Verge of Five-Year Low as Recovery Hopes Fade

Recent data indicates that Chinese stock markets are approaching a five-year low, highlighting the deteriorating economic situation in the country. Investors are losing faith in the prospects for economic recovery, particularly following the publication of short-term economic indicators suggesting a slowdown in growth. The CSI 300 index, which includes shares of the largest companies, is currently showing a decline, and many experts predict that this downturn could lead to new lows.

One of the reasons for this decline is the ineffective response of authorities to recent economic challenges, including contraction in industrial production and weakening consumer demand. Data confirms that China's economic growth continues to stagnate, which has led to excessive hopes for recovery following the pandemic.

Investors express negative sentiment in the market, citing deteriorating sentiment that has emerged after recent economic data releases. At the same time, we observe a worsening credit policy, as a significant number of small and medium-sized enterprises face funding shortages, which negatively impacts the overall state of the economy.

One key theme in discussions remains the question of whether authorities will be willing to introduce additional stimulus measures to support the economy and restore investor confidence. As of now, there are few signals that such measures will be sufficient to significantly alter the current economic course.

#China #StockMarkets #Economy #Investments #Low #CSI300 #Recovery